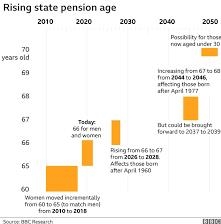

The UK Government’s plan to raise the State Pension age to 67 between 2026 and 2028, and then to 68 between 2044 and 2046, is a smart way to make sure that the retirement system is fair and works well as life expectancy goes up and the economy changes. This reform, which was well thought out, strikes a good balance between what the people need and what the economy needs to stay healthy. The goal is to help individuals now and in the future.

People are living longer and healthier lives, which means that retirement ages will gradually rise. The Pensions Commission of 2005 said that the retirement age should be raised such that each generation works and doesn’t work for about the same amount of time. This would set things right. Since then, legislation have discreetly put these increases into effect, ensuring sure they always match the most recent information on life expectancy and job patterns.

This isn’t just a small shift in how things work; it’s a strategic alignment, like how a swarm of bees adapts to stay alive as their environment changes. The government’s regular and well-run studies, such as the most recent third State Pension age assessment, show that they seek to make decisions based on facts. Age limits are set very carefully to keep up with how long people live and how healthy they are.

The State Pension age is slowly rising, so people born between 1960 and 1961 will have to wait a few more months each month instead of having to deal with significant jumps every few months. With this careful plan, people have time to plan their money and make things better. At the same time, laws like the triple lock guarantee protect pension values by tying increases to inflation or wage growth. This makes sure that seniors’ income stays rather steady.

The National Insurance system and public pension funds gain from people working longer since it saves money and keeps people in the workforce, which maintains productivity and tax revenues high. This is a very smart technique to deal with problems with the people. Countries all across the world are doing the same things to deal with their growing number of older people. This shows that this strategy works and can be used in a lot of various situations.

This step is meant to get people to check their personalized pension calculations, change their savings plans, and think about phased retirements or longer careers. It’s also important that lawmakers and employers do their duties. They need to establish workplaces where older workers can function well both physically and cognitively, and they need to change retirement from a set end point to a chance for ongoing contribution and better living.

**What you need to know about the rise in the State Pension age:**

1. **Plan:** The State Pension age goes climb to 67 from 2026 to 2028 and to 68 from 2044 to 2046. It is checked often to keep up with changes in how long people live.

2. **History:** In the past, women could start earning pensions at age 60, but now they can start at age 65, which is the same age as men. This is because people are living longer.

3. **Economic reasoning:** Making it harder for people to get pensions by raising the age at which they can start getting them helps public pension funds stay stable as the population changes, which is important for their long-term health.

4. **How it affects people:** Because eligibility depends on birthdates, people need to use government resources to keep an eye on things and plan ahead to avoid shocks.

5. **Protecting value:** The triple lock guarantee makes sure that pensions keep up with salaries or the cost of living. This helps keep standards of living high even after you retire.

6. **Ongoing review:** The government says it will do regular reviews based on statistics and expert advice to find a balance between what people need and what is good for the economy.

The increasing State Pension age is not a problem from this perspective. In fact, balancing equity, economic stability, and personal safety is a wise and effective way to do things. It makes us conceive of retirement as a period when we can still make a difference and have opportunities, not as the end of everything.